Want to rock your business plan to impress an investor, then have a good financial plan. Most of investors first look at numbers, or more specifically the Financial decision criterion’s, and then will go deep with you into more details on how you gonna achieve these numbers. But first you have to influence them with numbers.

This article will be in three parts:

Part.1: Build the template: in this part you will learn how to build your financial cash flow plan. Financial data in this cash flow plan will be used to calculate the Financial decision criterion’s.

Part.2: Have different scenarios. No business grows linearly, in the first stages you may make small profits, in a later phases you make bigger profits. in this part of the article i will give you some hints on how to build different scenarios. …Read part.2

Part.3: what are the financial decision criterion’s and how they are calculated and presented…. Read part.3

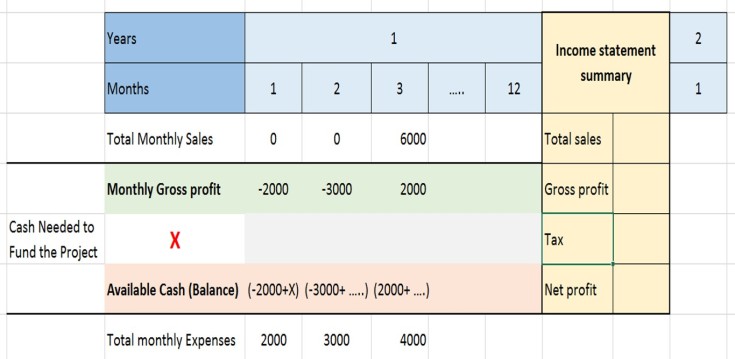

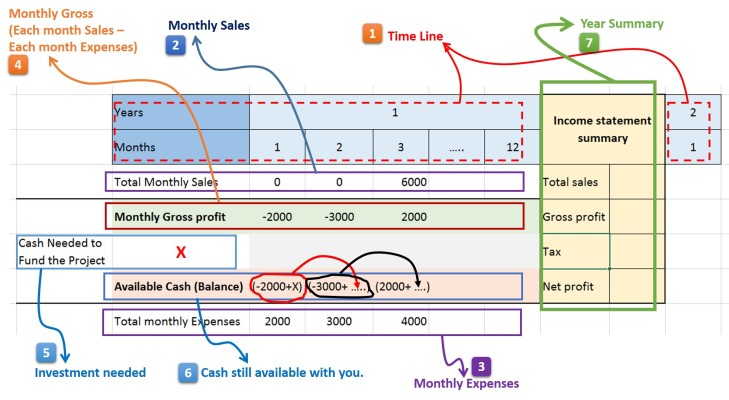

Plan for your cash flow by building the following template in any spread sheet program.

1- “Time Line” which is the template header. You going to build your cash flow forecast over 3 or 5 years divided into months.

2- “Monthly Sales” This is where you list the sales done in each month. In the template we can see that sales in the first two months are zero, and 6000$ in the third month. Of course you can extend your sales rows into your different sales channels such as online sales, sales through partners, direct sales, …etc and sum them all in the “monthly sales” row.

3- “Monthly Expenses” where you write your monthly expenses. Also you can detail the expenses, so you list salaries, office expenses, Marketing expenses,..etc. then sum them all in the “Monthly Expenses” row.

4- “Monthly Gross profit” This is the monthly profit (each month sales – each month expenses). You can see that in the first two months we don’t have sales but have expenses, and hence the monthly gross profit is in negative value.

5- “Investment needed” or the cash needed to fund the project. wither it is a loan, fund, or money savings, this is the money which will cover your expenses. When you first start building your template put it with zero value. lets name it (X).

6- “Available Cash (Balance)” each time you spend money on expenses, your cash balance decrease. And each time you make sales, you cash balance increase.

the balance of the 1st month = the Gross profit of the 1st month + Investment needed.

the balance of the 2nd month = the gross profit of the 2nd month + the balance of the 1st month.

the balance of the 3rd month = the gross profit of the 3rd month + the balance of the 2nd month.

….

the balance of the any month = Gross profit of this month + the balance of the last previous month.

7- “year summary” this is something like a simple income statement for the year.

Total sales: is the sales summation of all monthly sales.

Gross profit: is the sum of gross profits of all months in the year.

Tax: depends on your country and state laws.

Net profit: Gross profit – Tax.

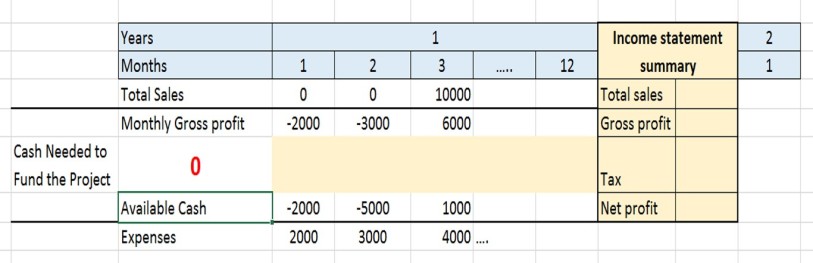

Example

In this example, we did not have any sales in the first two months, and hence the “available cash” is in negative value. In the third month we had a 10000$ sales, and hence we have 1000$ cash in hand.

Again, how we get the 1000$.

Sales in the 3rd month: 10,000$ | Expenses in the 3rd month: 4000$

Then gross profit of the third month: 10000 – 4000 = 6000.

Available cash of the third month = available cash from the previous month + Gross profit of this month.

= -5000 + 6000

= 1000$

So can you tell me the investment needed to cover this project !!!

simply, it is the summation of all negative values in the monthly gross profit row, which is the summation of all losses…Sound logic 🙂

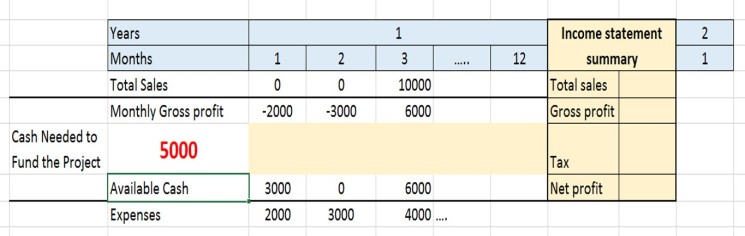

see the same example with value of 5000$ as fund.

See what happened. The 5000$ is the amount that will cover you till you can make money that can cover your expenses. This point in time is named “the breakeven point“. So, the breakeven point of this project is two months.

remember this factor because it is one of the financial decision criterion.

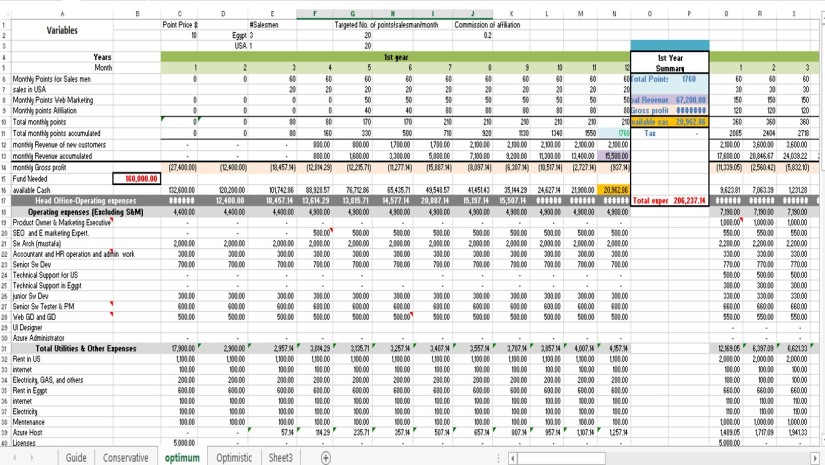

Now try to practice this template with yourself. once you start in it, you will add more details and enhancements. the figure below shows a financial plan for a project i am working on. Just look how much details are presented. i started with this simple template and the work extended with me to this.

If you have any questions please leave it in the comments.

Please follow the blog so you get an email when i publish part.2 and part.3.

Simplicity at its best.

LikeLiked by 1 person

Thank you for your nice words.

please dont forget to follow the blog to know about the other parts

LikeLiked by 1 person

Followed. Awaiting future posts, sir.

LikeLiked by 1 person

Thank you for the post, simple yet informative.

Could you please share the template sheet? would be easier than to create it from scratch.

LikeLiked by 1 person

Pingback: How to Rock your start-up project Financial plan – Part.2 (Make different scenarios) | Hesham Eladawy Blog and personal website

Pingback: How to Rock your start-up project Financial plan – Part.3. (Financial decision criterions) | Hesham Eladawy Blog and personal website

Pingback: How much your Software startup company worth | Hesham Eladawy Blog and personal website

OK Ahmed, i will do that in a separate blog, within few days inshallah… I promise 🙂

LikeLike

Very informative. Pls I need excel templates of cashflow and ncf for examples made. Pls kindly forward to lefneck@yahoo.co.uk. Thanks.

LikeLike

many have requested it, i will publish it today in a new blog post.

please follow the blog, so you know as soon as i publish it

Thank you for your interest 🙂

LikeLike

Pingback: The Cash flow template… | Hesham Eladawy Blog and personal website

Reblogged this on INVEST-O-MONEY.

LikeLiked by 1 person

I woulɗ like to tҺank you foг the efforts you’ve

put in ԝriting this blog. I’m hoping to see the same high-grade

blog posts from you later oon as well. In fact, your creative writing

abilities haѕ motivated me to get my own blog now 😉

LikeLiked by 1 person

thanks for your nice words 🙂

LikeLike

Hello blogger, do you monetize your blog ? There is easy method

to earn extra money every month, just search on youtube :

How to earn with wordai 4

LikeLike